How much can i borrow on a shared ownership mortgage

An estimate of your maximum mortgage 2. Maintenance payments andor childcare costs.

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Secured Vs Unsecured Lines Of Credit What S The Difference

Under the scheme the cost of home ownership is made more affordable because you can start by buying as little as 25 share in a property and your deposit can be 5 of the price of that share.

. Shared ownership mortgages could allow you to buy between 25 and 75 of a property with a. The Shared Ownership scheme is an alternative solution for first time buyers and home movers when you are unable to afford 100 of a home. You need to save a deposit and then you can borrow up to a certain amount from a mortgage lender.

A 0 mortgage where the borrower could borrow up to 25 of the. Total of service charge and rent. Total monthly credit commitments - eg.

Theyre also known as part buy part rent mortgages and are offered by housing associations. For example if the property is worth 200000 and the share owned by the leaseholder is 50 the. For example the minimum deposit and income requirements for a 230000 home are.

The buyer purchases a share of the. However for a Shared Ownership mortgage deposit you only need to save up 5-10 of. You buy a share of a new-build or existing home from a housing association then pay rent on the rest.

First you input the propertys total price the. Bank loans hire purchase catalogues. The decision that the calculator gives you is a guide only and not the.

Before we can buy a place together we need to work out how much you can afford based on your income and outgoings. From what weve seen initial rates can vary from 146 to 219 for two. You could lose your home if you do not keep up payments on your mortgage.

50 share requires a 5 deposit which equates to 5750 and a minimum income of 27600 and. The minimum amount of share you can have in a property has reduced from 25 to 10. The rent is generally calculated at 3 of the equity owned by the landlord.

Shared Ownership Mortgages Finding the mortgage deal that makes a house your home. Mortgages are secured on your home. This would cost you 40000 in total so you might put down a 10 deposit of 4000 and take out a 36000 mortgage for the rest.

Your deposit age and the loan to value age which together add up to 100 You can now look. A repayment calculator for shared ownership is a calculator that can help you to understand how your monthly repayments will change over time. Shared ownership grants the opportunity to.

Shared ownership schemes are intended to help people who cannot afford to buy a suitable home in any other way. The shared ownership scheme allows people to buy a share in their home even if they cannot afford a mortgage on the entire value of the property. Shared ownership mortgages are designed to assist people getting onto the property ladder who may.

Think carefully before securing other debts against your home. On top of this monthly mortgage payment youll also need to. You can buy additional shares in 1 instalments instead of the former 5 or 10.

Applicants can buy between 25 and 75 of the property and buying a larger share later at a price based on the value of the property at the time is also possible. The property prices you should look for 3. Most shared ownership mortgages will begin with a lower initial rate before moving onto their subsequent rate.

A shared ownership mortgage enables you to part rent and part buy.

Pin On Housing Market

Renting Vs Owning A Home Buying First Home Real Estate Tips Home Buying Tips

First Time Home Buyer In Ontario With Low Income Woodstreet Mortgage

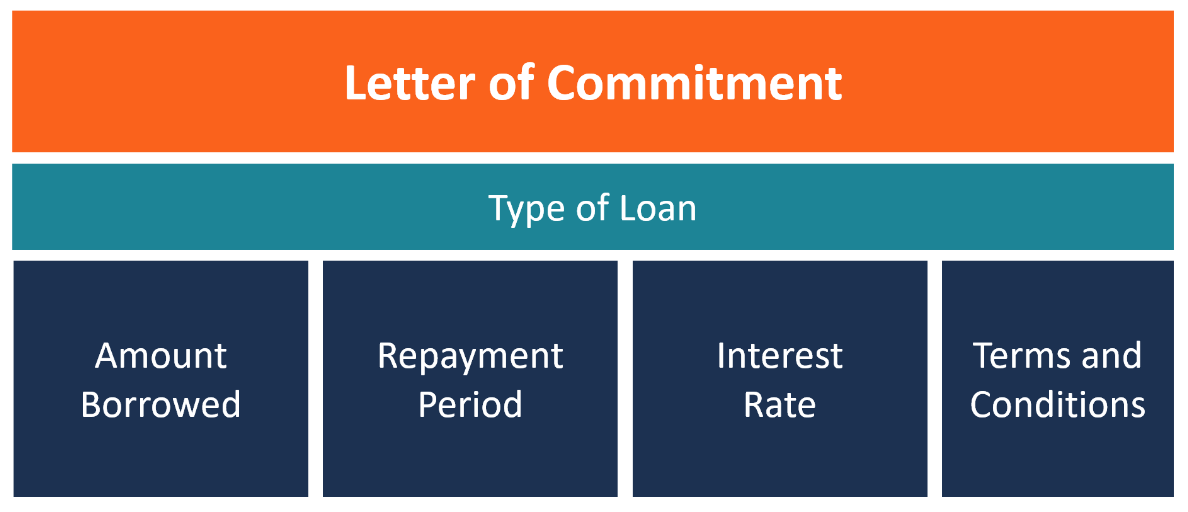

Letter Of Commitment Overview Example And Contents

Cristina Ferrara On Instagram Mortgage Interest Rates Have Dropped Considerably Over The Past Year Locking A Mortgage Interest Rates Interest Rates Mortgage

First Time Buyer Guide How Much Can I Borrow Moneybox Save And Invest

![]()

Pros And Cons Of Joint Mortgages Loans Canada

Self Employed Mortgage Calculator Haysto

How Much Can You Afford To Borrow On A Mortgage Forbes Advisor Uk

Can I Get A Mortgage Canada How To Qualify

Family Loan Agreements Lending Money To Family Friends

Steps To Buying A House Home Buying Tips Home Buying Buying First Home

Key Terms To Know In The Homebuying Process Infographic Real Estate With Keeping Current Matters Home Buying Process Home Buying Real Estate Terms

Self Employed Mortgage Calculator Haysto

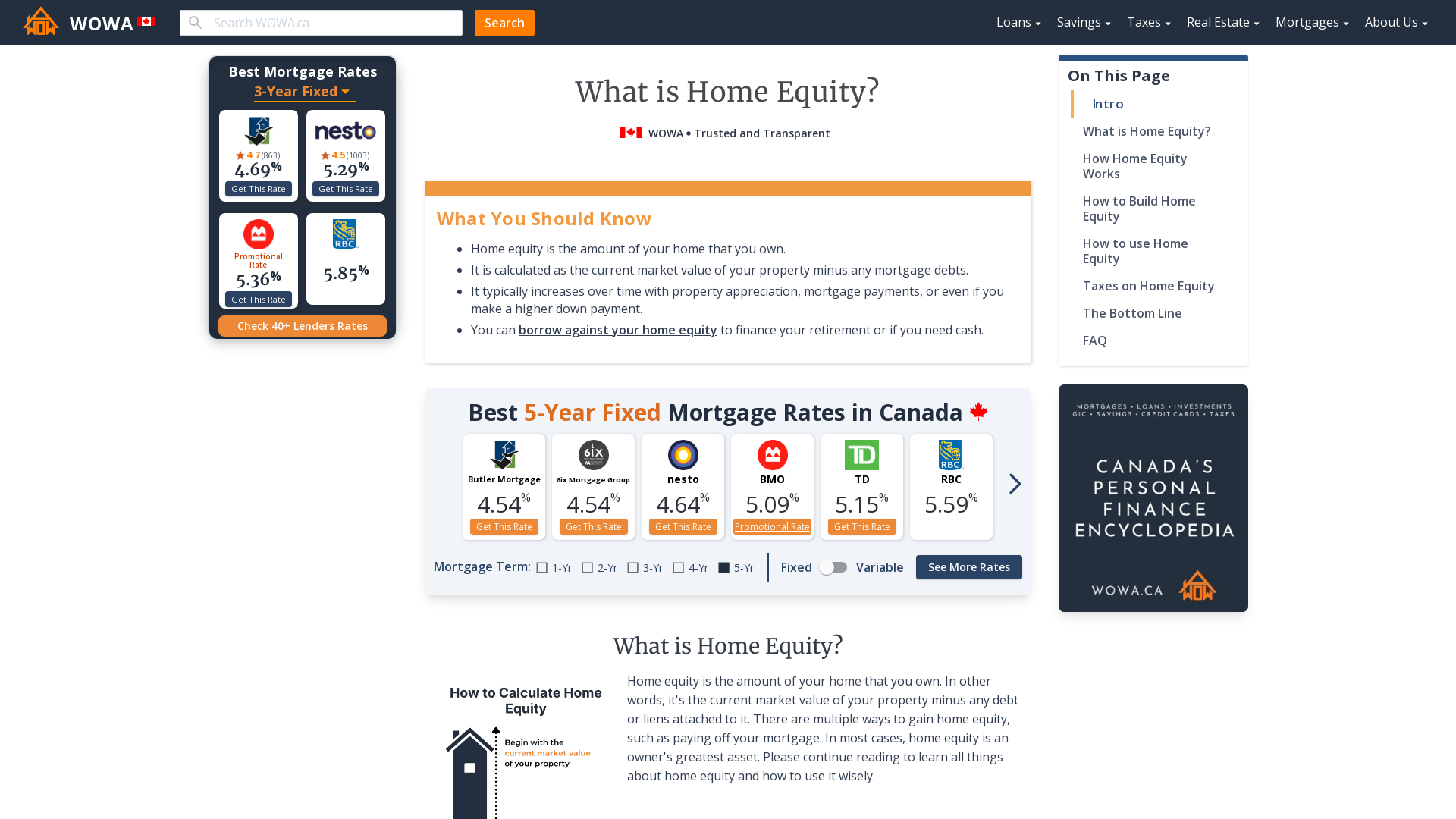

What Is Home Equity Wowa Ca

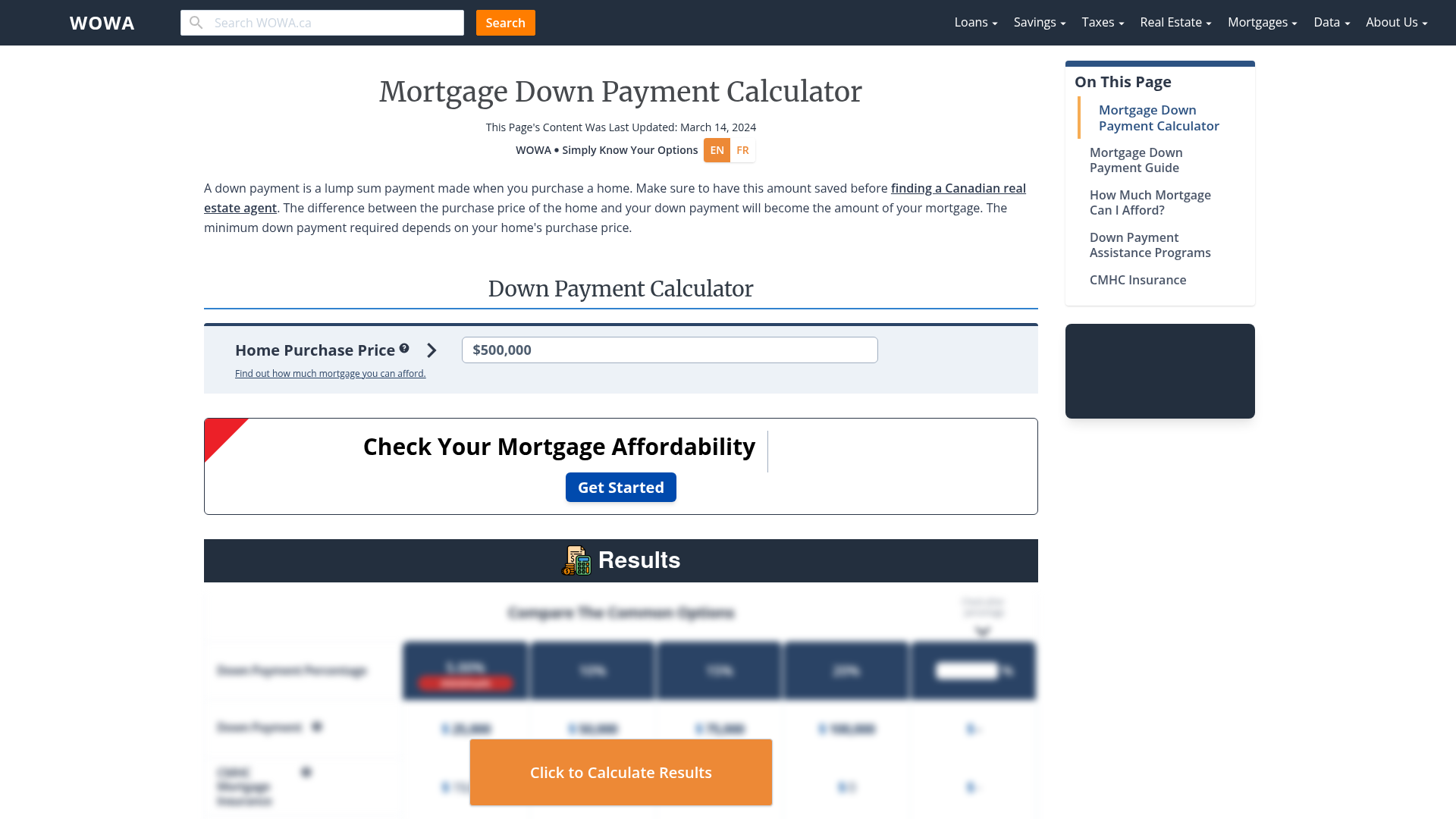

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca

How To Increase The Amount You Can Borrow My Simple Mortgage